TERS Report Changes

The TERS Report has been amended and was released on 31 August.

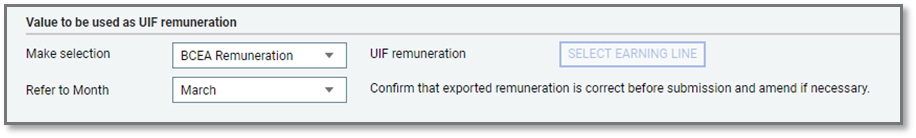

Make selection

A definition of ‘remuneration’ was added and refers to ‘remuneration as defined in the Basic Conditions of Employment Act (BCEA), read with section 35(5) of the BCEA and Government Gazette 24889’.

Therefore, the employer must report BCEA remuneration as ‘monthly remuneration’ and ‘remuneration received during lockdown’ and not UIF remuneration as defined in the UICA, as per the previous directives.

It is our understanding that the remuneration to be used for applications before July (27 March – 30 June) should be UIF remuneration (as defined in the Unemployment Insurance Contributions Act) as previously communicated. We have requested confirmation from the DoEL.

Even though it is recommended that you select the BCEA Remuneration value, for the period 1 July to 15 August, the report allows you flexibility depending on your setup. Therefore, you have additional options to select specific Earnings, Rate per day calculation or a Calculation screen line. You can select:

-

Select BCEA Remuneration (From 1 July)

-

BCEA Remuneration XS Screen – (will export the value on the selected calculation line in the current period) (From 1 July)

-

UIF Remuneration

-

Select a specific Earing line or multiple Earning lines to be added together.

-

Rate per day calculation – This option uses the employee rate per day on the increase screen X 21.667 days per month.

Please Note:

If your company is not setup to correctly calculate BCEA values, we recommend that you calculate the value to be exported in the TERS file and capture it in the current period on the employee Calculation (XS) screen.

The TERS export can then read the BCEA value from the Calculation screen.

Refer to Month (new selection field)

The value to be reflected in the file must be for the last fully remuneratedpayroll month before lockdown. If you paid your employees in full in March, select March, else you can select February as your last fully paid payroll month.

Based on the period selected, the report will export the relevant values. E.g. if you select BCEA Remuneration for February, the report will export the BCEA Remuneration values for the month of February in the report. (In weekly/bi-weekly companies the month to date value of this field /fields will export in the file, based on BCEA setup).

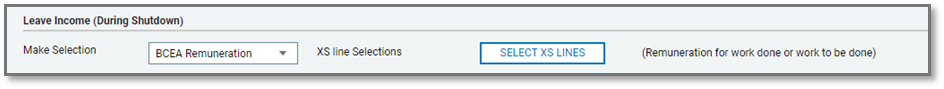

The employer must report BCEA remuneration as ‘remuneration received during shutdown’.

Employers should extract BCEA Remuneration for 6 weeks (1 July – 15 August).

The system will allow you to select an XS line (Calculation screen line) and then extract the current period value on the selected line to be included in the file.

Setup suggestions would be:

-

Define a calculation screen line, with a formula of calculation, that can calculate the BCEA termination rate X the number of days that the employee worked during the period 1 July to 15 August. This value will then be included as the – Remuneration for work done or to be done in July and August.

-

Alternatively, if the BCEA setup in your company is incorrect, you can calculate the value to be included manually and add it to the calculation line.

This will allow the export to include the correct values in the file.

It is our understanding that the remuneration to be used for applications before July (27 March – 30 June) should be UIF remuneration (as defined in the Unemployment Insurance Contributions Act) as previously communicated. We have requested confirmation from the DoEL.

Click on “Select Earning Lines” to select the earning line or lines that is/are used for payment during lockdown. (In weekly companies the month-to-date value of this field/ fields will export in the file).

If no payment was made to employees during the shutdown period, no selections are required in this section.